Credit Analyst

Nottinghamshire > Nottingham

The median Credit Analyst salary in Nottingham is £42,500 per year, according to job vacancies posted during the 6 months leading to 14 January 2026.

The table below compares current salary benchmarking and summary statistics with the previous two years.

| 6 months to 14 Jan 2026 |

Same period 2025 | Same period 2024 | |

|---|---|---|---|

| Rank | 52 | 42 | - |

| Rank change year-on-year | -10 | - | - |

| Permanent jobs requiring a Credit Analyst | 1 | 17 | 0 |

| As % of all permanent jobs in Nottingham | 0.20% | 3.26% | - |

| As % of the Job Titles category | 0.21% | 3.46% | - |

| Number of salaries quoted | 1 | 5 | 0 |

| 10th Percentile | - | £62,750 | - |

| 25th Percentile | £41,250 | £68,750 | - |

| Median annual salary (50th Percentile) | £42,500 | £82,500 | - |

| Median % change year-on-year | -48.48% | - | - |

| 75th Percentile | £43,750 | £86,250 | - |

| 90th Percentile | - | - | - |

| Nottinghamshire median annual salary | £42,500 | £82,500 | - |

| % change year-on-year | -48.48% | - | - |

All Permanent IT Job Roles

Nottingham

For comparison with the information above, the following table provides summary statistics for all permanent IT job vacancies in Nottingham. Most job vacancies include a discernible job title that can be normalized. As such, the figures in the second row provide an indication of the number of permanent jobs in our overall sample.

| Permanent vacancies in Nottingham with a recognized job title | 472 | 492 | 313 |

| % of permanent jobs with a recognized job title | 92.91% | 94.43% | 97.20% |

| Number of salaries quoted | 337 | 223 | 269 |

| 10th Percentile | £28,750 | £35,250 | £31,250 |

| 25th Percentile | £35,000 | £42,500 | £42,000 |

| Median annual salary (50th Percentile) | £50,000 | £57,500 | £52,500 |

| Median % change year-on-year | -13.04% | +9.52% | -4.55% |

| 75th Percentile | £65,000 | £70,000 | £65,000 |

| 90th Percentile | £80,000 | £82,250 | £75,250 |

| Nottinghamshire median annual salary | £45,000 | £55,000 | £50,000 |

| % change year-on-year | -18.18% | +10.00% | -9.09% |

Credit Analyst

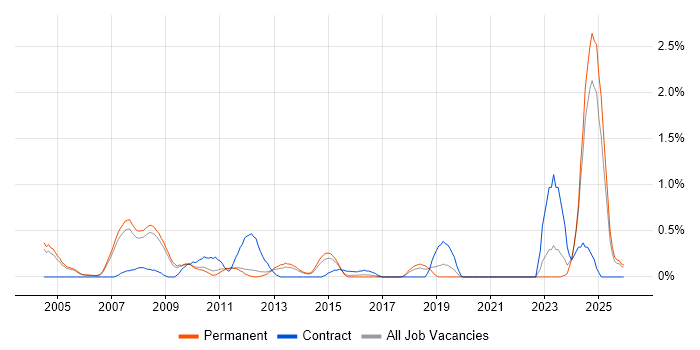

Job Vacancy Trend in Nottingham

Historical trend showing the proportion of permanent IT job postings featuring 'Credit Analyst' in the job title relative to all permanent IT jobs advertised in Nottingham.

Credit Analyst

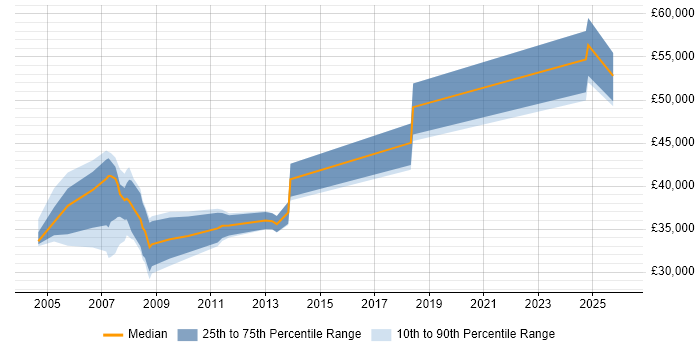

Salary Trend in Nottingham

Salary distribution trend for Credit Analyst job vacancies in Nottingham.

Credit Analyst Skill Set

Top 5 Co-Occurring Skills & Capabilities in Nottingham

For the 6 months to 14 January 2026, Credit Analyst job roles required the following skills and capabilities in order of popularity. The figures indicate the absolute number of co-occurrences and as a proportion of all permanent job ads across the Nottingham region featuring Credit Analyst in the job title.

|

Credit Analyst Skill Set

Co-Occurring Skills & Capabilities in Nottingham by Category

The following tables expand on the one above by listing co-occurrences grouped by category. They cover the same employment type, locality and period, with up to 20 co-occurrences shown in each category:

|

|

||||||||||||||||||

|

|||||||||||||||||||