Oracle E-Business Tax (ebTax)

UK

The table below provides summary statistics for permanent job vacancies requiring Oracle E-Business Tax skills. It includes a benchmarking guide to the annual salaries offered in vacancies that cited Oracle E-Business Tax over the 6 months leading up to 28 May 2025, comparing them to the same period in the previous two years.

| 6 months to 28 May 2025 |

Same period 2024 | Same period 2023 | |

|---|---|---|---|

| Rank | - | 908 | - |

| Rank change year-on-year | - | - | - |

| Permanent jobs citing Oracle E-Business Tax | 0 | 2 | 0 |

| As % of all permanent jobs advertised in the UK | - | 0.002% | - |

| As % of the Business Applications category | - | 0.044% | - |

| Number of salaries quoted | 0 | 1 | 0 |

| Median annual salary (50th Percentile) | - | £65,000 | - |

| UK excluding London median annual salary | - | - | - |

All Business Application Skills

UK

Oracle E-Business Tax falls under the Business Applications category. For comparison with the information above, the following table provides summary statistics for all permanent job vacancies requiring business application skills.

| Permanent vacancies with a requirement for business application skills | 2,696 | 4,566 | 6,059 |

| As % of all permanent jobs advertised in the UK | 4.93% | 4.47% | 6.19% |

| Number of salaries quoted | 1,767 | 2,958 | 3,478 |

| 10th Percentile | £32,500 | £31,425 | £39,850 |

| 25th Percentile | £38,750 | £42,500 | £48,750 |

| Median annual salary (50th Percentile) | £55,000 | £56,500 | £60,000 |

| Median % change year-on-year | -2.65% | -5.83% | +4.35% |

| 75th Percentile | £75,000 | £75,000 | £75,000 |

| 90th Percentile | £102,500 | £92,500 | £95,000 |

| UK excluding London median annual salary | £50,055 | £50,000 | £57,500 |

| % change year-on-year | +0.11% | -13.04% | +15.00% |

Oracle E-Business Tax

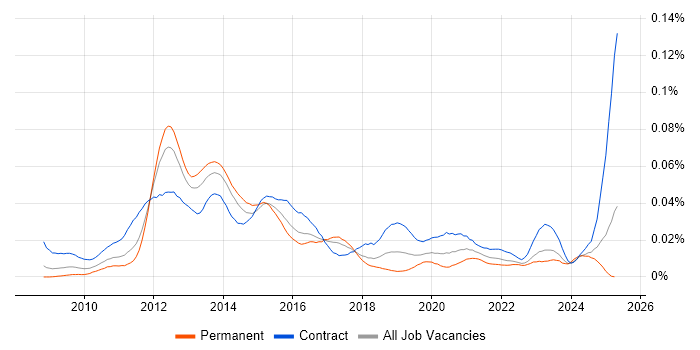

Job Vacancy Trend

Job postings citing Oracle E-Business Tax as a proportion of all IT jobs advertised.

Oracle E-Business Tax

Salary Trend

3-month moving average salary quoted in jobs citing Oracle E-Business Tax.