Oracle E-Business Tax (ebTax)

UK

The table below provides summary statistics and contractor rates for jobs requiring Oracle E-Business Tax skills. It covers contract job vacancies from the 6 months leading up to 24 February 2026, with comparisons to the same periods in the previous two years.

| 6 months to 24 Feb 2026 |

Same period 2025 | Same period 2024 | |

|---|---|---|---|

| Rank | 594 | 518 | 580 |

| Rank change year-on-year | -76 | +62 | +153 |

| Contract jobs citing Oracle E-Business Tax | 10 | 9 | 2 |

| As % of all contract jobs in the UK | 0.024% | 0.030% | 0.005% |

| As % of the Business Applications category | 0.32% | 0.38% | 0.057% |

| Number of daily rates quoted | 5 | 3 | 1 |

| 10th Percentile | - | £590 | - |

| 25th Percentile | £650 | £631 | £425 |

| Median daily rate (50th Percentile) | £700 | £700 | £450 |

| Median % change year-on-year | - | +55.56% | -9.55% |

| 75th Percentile | £925 | £703 | £475 |

| 90th Percentile | - | £705 | - |

| UK excluding London median daily rate | - | - | - |

All Business Application Skills

UK

Oracle E-Business Tax falls under the Business Applications category. For comparison with the information above, the following table provides summary statistics for all contract job vacancies requiring business application skills.

| Contract vacancies with a requirement for business application skills | 3,113 | 2,393 | 3,526 |

| As % of all contract IT jobs advertised in the UK | 7.60% | 7.92% | 7.94% |

| Number of daily rates quoted | 1,765 | 1,312 | 2,020 |

| 10th Percentile | £359 | £380 | £388 |

| 25th Percentile | £450 | £475 | £463 |

| Median daily rate (50th Percentile) | £550 | £565 | £550 |

| Median % change year-on-year | -2.65% | +2.73% | - |

| 75th Percentile | £650 | £661 | £669 |

| 90th Percentile | £742 | £775 | £751 |

| UK excluding London median daily rate | £550 | £550 | £525 |

| % change year-on-year | - | +4.76% | - |

| Number of hourly rates quoted | 101 | 56 | 119 |

| 10th Percentile | £18.75 | £22.27 | £16.09 |

| 25th Percentile | £33.75 | £35.00 | £22.33 |

| Median hourly rate | £56.44 | £60.00 | £47.50 |

| Median % change year-on-year | -5.93% | +26.32% | +27.35% |

| 75th Percentile | £68.75 | £80.75 | £60.13 |

| 90th Percentile | £90.09 | £86.00 | £86.50 |

| UK excluding London median hourly rate | £56.50 | £60.00 | £47.50 |

| % change year-on-year | -5.83% | +26.32% | +27.35% |

Oracle E-Business Tax

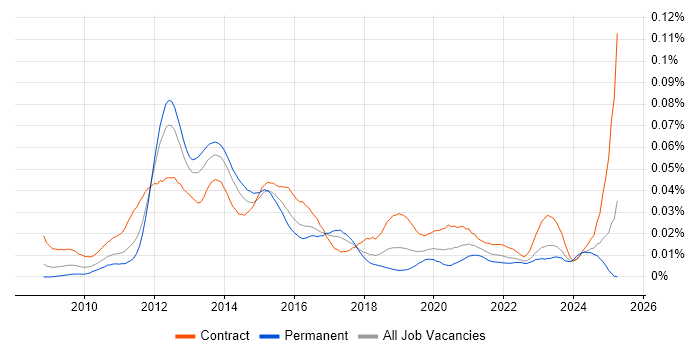

Job Vacancy Trend

Historical trend showing the proportion of contract IT job postings citing Oracle E-Business Tax relative to all contract IT jobs advertised.

Oracle E-Business Tax

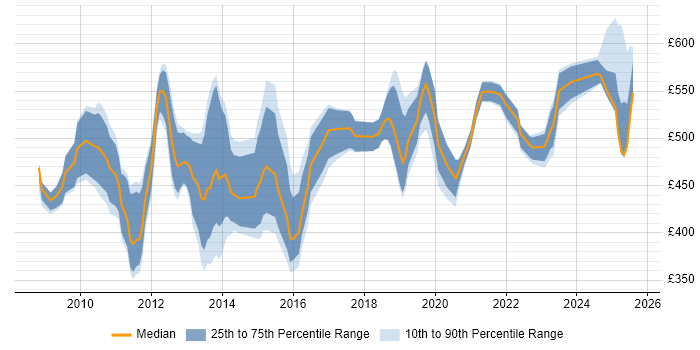

Daily Rate Trend

Contractor daily rate distribution trend for jobs in the UK citing Oracle E-Business Tax.

Oracle E-Business Tax

Daily Rate Histogram

Daily rate distribution for jobs citing Oracle E-Business Tax over the 6 months to 24 February 2026.

Oracle E-Business Tax

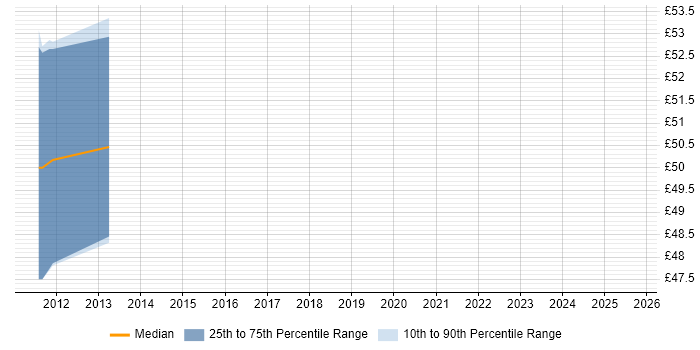

Hourly Rate Trend

Contractor hourly rate distribution trend for jobs in the UK citing Oracle E-Business Tax.

Oracle E-Business Tax

Top 6 Contract Job Locations

The table below looks at the demand and provides a guide to the median contractor rates quoted in IT jobs citing Oracle E-Business Tax within the UK over the 6 months to 24 February 2026. The 'Rank Change' column provides an indication of the change in demand within each location based on the same 6 month period last year.

| Location | Rank Change on Same Period Last Year |

Matching Contract IT Job Ads |

Median Daily Rate Past 6 Months |

Median Daily Rate % Change on Same Period Last Year |

Live Jobs |

|---|---|---|---|---|---|

| England | -70 | 7 | £900 | +28.57% | 1 |

| Work from Home | -11 | 5 | £900 | +28.02% | 1 |

| London | -45 | 4 | £900 | +28.57% | 1 |

| UK excluding London | - | 4 | - | - | 1 |

| South East | - | 3 | - | - | 1 |

| Scotland | - | 1 | - | - |

Oracle E-Business Tax

Co-Occurring Skills & Capabilities by Category

The following tables expand on the one above by listing co-occurrences grouped by category. They cover the same employment type, locality and period, with up to 20 co-occurrences shown in each category: