Credit Risk Analyst

UK

The median Credit Risk Analyst daily rate in the UK is £619, according to job vacancies posted in the 6 months leading up to 20 September 2025.

The table below provides contractor rate benchmarking and summary statistics, comparing them to the same period in the previous two years.

| 6 months to 20 Sep 2025 |

Same period 2024 | Same period 2023 | |

|---|---|---|---|

| Rank | 553 | 537 | 612 |

| Rank change year-on-year | -16 | +75 | +222 |

| Contract jobs requiring a Credit Risk Analyst | 9 | 20 | 32 |

| As % of all contract jobs advertised in the UK | 0.027% | 0.052% | 0.064% |

| As % of the Job Titles category | 0.030% | 0.056% | 0.068% |

| Number of daily rates quoted | 6 | 13 | 22 |

| 10th Percentile | £409 | £446 | £432 |

| 25th Percentile | £468 | - | £443 |

| Median daily rate (50th Percentile) | £619 | £600 | £658 |

| Median % change year-on-year | +3.13% | -8.75% | -3.31% |

| 75th Percentile | £697 | £626 | £833 |

| 90th Percentile | £731 | - | £1,188 |

| UK excluding London median daily rate | £588 | £618 | £450 |

| % change year-on-year | -4.86% | +37.22% | -18.18% |

All Contract IT Job Vacancies

UK

For comparison with the information above, the following table provides summary statistics for all contract IT job vacancies. Most job vacancies include a discernible job title that can be normalized. As such, the figures in the second row provide an indication of the number of contract jobs in our overall sample.

| Contract vacancies in the UK with a recognized job title | 29,964 | 35,807 | 47,071 |

| % of contract IT jobs with a recognized job title | 91.07% | 92.94% | 94.20% |

| Number of daily rates quoted | 18,916 | 22,003 | 32,212 |

| 10th Percentile | £278 | £300 | £300 |

| 25th Percentile | £400 | £413 | £420 |

| Median daily rate (50th Percentile) | £500 | £525 | £530 |

| Median % change year-on-year | -4.76% | -0.94% | -3.64% |

| 75th Percentile | £625 | £638 | £650 |

| 90th Percentile | £725 | £750 | £750 |

| UK excluding London median daily rate | £475 | £500 | £500 |

| % change year-on-year | -5.00% | - | - |

| Number of hourly rates quoted | 1,585 | 1,672 | 1,513 |

| 10th Percentile | £13.75 | £14.73 | £15.00 |

| 25th Percentile | £17.29 | £20.30 | £19.06 |

| Median hourly rate | £25.15 | £43.00 | £44.50 |

| Median % change year-on-year | -41.51% | -3.37% | +71.15% |

| 75th Percentile | £52.16 | £65.00 | £65.00 |

| 90th Percentile | £70.00 | £75.00 | £77.50 |

| UK excluding London median hourly rate | £25.15 | £45.00 | £43.83 |

| % change year-on-year | -44.11% | +2.68% | +99.20% |

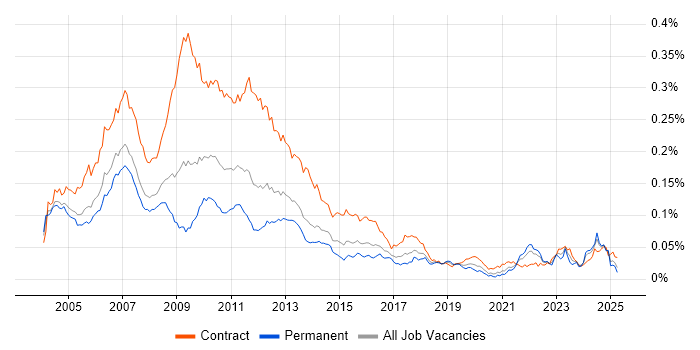

Credit Risk Analyst

Job Vacancy Trend

Job postings that featured Credit Risk Analyst in the job title as a proportion of all IT jobs advertised.

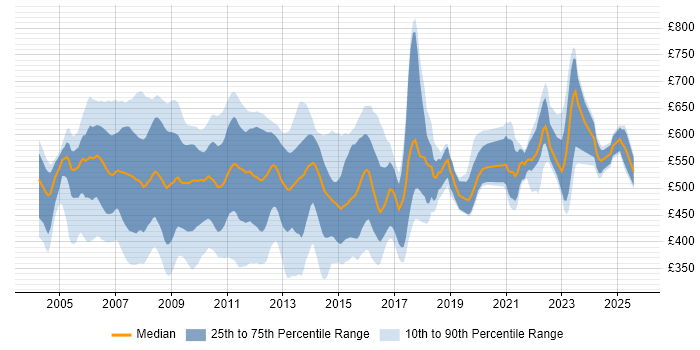

Credit Risk Analyst

Daily Rate Trend

Contractor daily rate distribution trend for Credit Risk Analyst job vacancies in the UK.

Credit Risk Analyst

Daily Rate Histogram

Daily rate distribution for jobs citing Credit Risk Analyst over the 6 months to 20 September 2025.

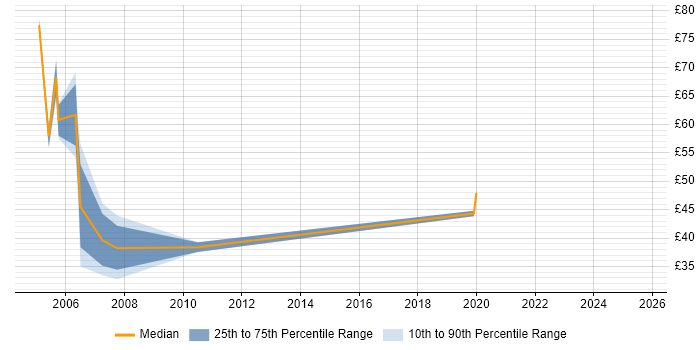

Credit Risk Analyst

Hourly Rate Trend

Contractor hourly rate distribution trend for Credit Risk Analyst job vacancies in the UK.

Credit Risk Analyst

Top 6 Contract Job Locations

The table below looks at the demand and provides a guide to the median contractor rates quoted in IT jobs citing Credit Risk Analyst within the UK over the 6 months to 20 September 2025. The 'Rank Change' column provides an indication of the change in demand within each location based on the same 6 month period last year.

| Location | Rank Change on Same Period Last Year |

Matching Contract IT Job Ads |

Median Daily Rate Past 6 Months |

Median Daily Rate % Change on Same Period Last Year |

Live Jobs |

|---|---|---|---|---|---|

| England | 0 | 6 | £443 | -26.25% | 32 |

| London | +7 | 4 | £443 | -26.25% | 23 |

| Work from Home | +28 | 3 | £650 | +82.33% | 20 |

| UK excluding London | -1 | 3 | £588 | -4.86% | 22 |

| South East | - | 2 | - | - | 17 |

| Northern Ireland | - | 1 | £588 | - |

Credit Risk Analyst Skill Set

Top 30 Co-occurring Skills and Capabilities

For the 6 months to 20 September 2025, Credit Risk Analyst contract job roles required the following skills and capabilities in order of popularity. The figures indicate the absolute number co-occurrences and as a proportion of all contract job ads featuring Credit Risk Analyst in the job title.

|

|

Credit Risk Analyst Skill Set

Co-occurring Skills and Capabilities by Category

The follow tables expand on the table above by listing co-occurrences grouped by category. The same employment type, locality and period is covered with up to 20 co-occurrences shown in each of the following categories: