Credit Risk Modelling

UK > England

The table below provides summary statistics for permanent job vacancies advertised in England requiring Credit Risk Modelling skills. It includes a benchmarking guide to the annual salaries offered in vacancies that cited Credit Risk Modelling over the 6 months leading up to 27 May 2025, comparing them to the same period in the previous two years.

| 6 months to 27 May 2025 |

Same period 2024 | Same period 2023 | |

|---|---|---|---|

| Rank | 657 | 835 | 849 |

| Rank change year-on-year | +178 | +14 | +273 |

| Permanent jobs citing Credit Risk Modelling | 11 | 17 | 61 |

| As % of all permanent jobs advertised in England | 0.023% | 0.019% | 0.070% |

| As % of the Processes & Methodologies category | 0.024% | 0.023% | 0.073% |

| Number of salaries quoted | 7 | 16 | 35 |

| 10th Percentile | - | £40,800 | - |

| 25th Percentile | £45,000 | £45,263 | £37,879 |

| Median annual salary (50th Percentile) | £72,500 | £60,000 | £50,139 |

| Median % change year-on-year | +20.83% | +19.67% | -53.36% |

| 75th Percentile | £90,625 | £126,250 | £56,492 |

| 90th Percentile | £116,000 | £132,500 | - |

| UK median annual salary | £45,000 | £57,500 | £50,139 |

| % change year-on-year | -21.74% | +14.68% | -53.36% |

All Process and Methodology Skills

England

Credit Risk Modelling falls under the Processes and Methodologies category. For comparison with the information above, the following table provides summary statistics for all permanent job vacancies requiring process or methodology skills in England.

| Permanent vacancies with a requirement for process or methodology skills | 45,377 | 74,348 | 83,355 |

| As % of all permanent jobs advertised in England | 94.05% | 84.31% | 95.58% |

| Number of salaries quoted | 22,410 | 54,380 | 49,711 |

| 10th Percentile | £29,750 | £29,000 | £34,452 |

| 25th Percentile | £41,250 | £40,000 | £46,105 |

| Median annual salary (50th Percentile) | £57,500 | £55,000 | £62,500 |

| Median % change year-on-year | +4.55% | -12.00% | +4.17% |

| 75th Percentile | £75,000 | £72,500 | £82,500 |

| 90th Percentile | £98,750 | £93,750 | £102,500 |

| UK median annual salary | £57,500 | £55,000 | £61,000 |

| % change year-on-year | +4.55% | -9.84% | +1.67% |

Credit Risk Modelling

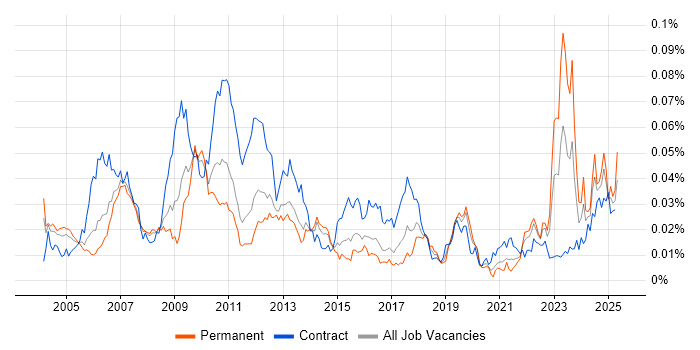

Job Vacancy Trend in England

Job postings citing Credit Risk Modelling as a proportion of all IT jobs advertised in England.

Credit Risk Modelling

Salary Trend in England

3-month moving average salary quoted in jobs citing Credit Risk Modelling in England.

Credit Risk Modelling

Salary Histogram in England

Salary distribution for jobs citing Credit Risk Modelling in England over the 6 months to 27 May 2025.

Credit Risk Modelling

Job Locations in England

The table below looks at the demand and provides a guide to the median salaries quoted in IT jobs citing Credit Risk Modelling within the England region over the 6 months to 27 May 2025. The 'Rank Change' column provides an indication of the change in demand within each location based on the same 6 month period last year.

| Location | Rank Change on Same Period Last Year |

Matching Permanent IT Job Ads |

Median Salary Past 6 Months |

Median Salary % Change on Same Period Last Year |

Live Jobs |

|---|---|---|---|---|---|

| London | +105 | 7 | £88,750 | +47.92% | 41 |

| Yorkshire | +66 | 3 | £45,000 | -12.67% | 11 |

| North of England | +48 | 3 | £45,000 | +4.17% | 20 |

| East Midlands | - | 1 | - | - | 10 |

| Midlands | - | 1 | - | - | 19 |

| Credit Risk Modelling UK |

|||||

Credit Risk Modelling

Co-occurring Skills and Capabilities in England by Category

The follow tables expand on the table above by listing co-occurrences grouped by category. The same employment type, locality and period is covered with up to 20 co-occurrences shown in each of the following categories: