Credit Analyst

UK

The median Credit Analyst salary in the UK is £72,500 per year, according to job vacancies posted during the 6 months leading to 30 May 2025.

The table below provides salary benchmarking and summary statistics, comparing them to the same period in the previous two years.

| 6 months to 30 May 2025 |

Same period 2024 | Same period 2023 | |

|---|---|---|---|

| Rank | 423 | 884 | 904 |

| Rank change year-on-year | +461 | +20 | +205 |

| Permanent jobs requiring a Credit Analyst | 303 | 28 | 58 |

| As % of all permanent jobs advertised in the UK | 0.55% | 0.027% | 0.060% |

| As % of the Job Titles category | 0.61% | 0.029% | 0.065% |

| Number of salaries quoted | 3 | 4 | 19 |

| 10th Percentile | - | £55,625 | - |

| 25th Percentile | £68,750 | £69,688 | £47,354 |

| Median annual salary (50th Percentile) | £72,500 | £84,750 | £50,139 |

| Median % change year-on-year | -14.45% | +69.03% | -49.86% |

| 75th Percentile | £90,625 | £99,125 | £65,000 |

| 90th Percentile | £99,250 | £103,400 | £72,500 |

| UK excluding London median annual salary | - | - | £50,139 |

| % change year-on-year | - | - | -49.86% |

All Permanent IT Job Vacancies

UK

For comparison with the information above, the following table provides summary statistics for all permanent IT job vacancies. Most job vacancies include a discernible job title that can be normalized. As such, the figures in the second row provide an indication of the number of permanent jobs in our overall sample.

| Permanent vacancies in the UK with a recognized job title | 50,066 | 97,923 | 88,829 |

| % of permanent jobs with a recognized job title | 90.36% | 94.81% | 91.43% |

| Number of salaries quoted | 26,124 | 69,761 | 56,179 |

| 10th Percentile | £28,750 | £28,500 | £32,500 |

| 25th Percentile | £40,750 | £38,500 | £45,000 |

| Median annual salary (50th Percentile) | £55,000 | £52,500 | £60,000 |

| Median % change year-on-year | +4.76% | -12.50% | - |

| 75th Percentile | £73,750 | £70,000 | £80,000 |

| 90th Percentile | £95,000 | £90,000 | £100,000 |

| UK excluding London median annual salary | £51,000 | £50,000 | £53,500 |

| % change year-on-year | +2.00% | -6.54% | +6.63% |

Credit Analyst

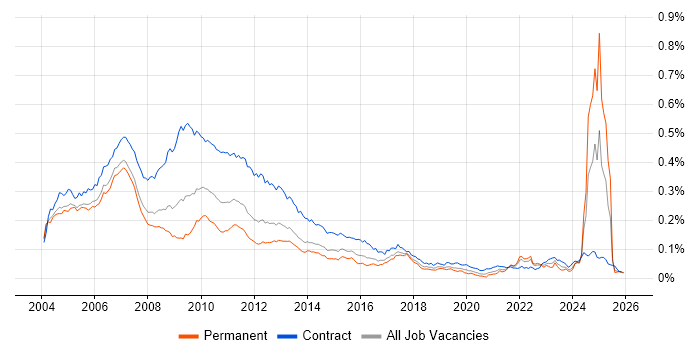

Job Vacancy Trend

Job postings that featured Credit Analyst in the job title as a proportion of all IT jobs advertised.

Credit Analyst

Salary Trend

3-month moving average salary quoted in jobs citing Credit Analyst.

Credit Analyst

Salary Histogram

Salary distribution for jobs citing Credit Analyst over the 6 months to 30 May 2025.

Credit Analyst

Top 11 Job Locations

The table below looks at the demand and provides a guide to the median salaries quoted in IT jobs citing Credit Analyst within the UK over the 6 months to 30 May 2025. The 'Rank Change' column provides an indication of the change in demand within each location based on the same 6 month period last year.

| Location | Rank Change on Same Period Last Year |

Matching Permanent IT Job Ads |

Median Salary Past 6 Months |

Median Salary % Change on Same Period Last Year |

Live Jobs |

|---|---|---|---|---|---|

| England | +416 | 298 | £72,500 | -14.45% | 22 |

| London | +331 | 263 | £72,500 | -14.45% | 13 |

| UK excluding London | +213 | 40 | - | - | 15 |

| East of England | - | 29 | - | - | |

| Work from Home | +120 | 5 | £105,000 | +44.83% | 7 |

| Midlands | +88 | 4 | - | - | 3 |

| East Midlands | +49 | 4 | - | - | 2 |

| Northern Ireland | - | 3 | - | - | |

| Scotland | +107 | 2 | - | - | |

| Yorkshire | +60 | 2 | - | - | |

| North of England | +49 | 2 | - | - |

Credit Analyst Skill Set

Top 30 Co-occurring Skills and Capabilities

For the 6 months to 30 May 2025, Credit Analyst job roles required the following skills and capabilities in order of popularity. The figures indicate the absolute number co-occurrences and as a proportion of all permanent job ads featuring Credit Analyst in the job title.

|

|

Credit Analyst Skill Set

Co-occurring Skills and Capabilities by Category

The follow tables expand on the table above by listing co-occurrences grouped by category. The same employment type, locality and period is covered with up to 20 co-occurrences shown in each of the following categories: