Credit Risk Analytics

UK > England

The table below provides summary statistics and salary benchmarking for jobs advertised in England requiring Credit Risk Analytics skills. It covers permanent job vacancies from the 6 months leading up to 6 January 2026, with comparisons to the same periods in the previous two years.

| 6 months to 6 Jan 2026 |

Same period 2025 | Same period 2024 | |

|---|---|---|---|

| Rank | 606 | 670 | 676 |

| Rank change year-on-year | +64 | +6 | +272 |

| Permanent jobs citing Credit Risk Analytics | 5 | 8 | 3 |

| As % of all permanent jobs in England | 0.010% | 0.016% | 0.006% |

| As % of the Processes & Methodologies category | 0.012% | 0.018% | 0.007% |

| Number of salaries quoted | 4 | 7 | 1 |

| 10th Percentile | £41,750 | £64,750 | - |

| 25th Percentile | £46,250 | £73,750 | - |

| Median annual salary (50th Percentile) | £60,000 | £82,500 | £65,000 |

| Median % change year-on-year | -27.27% | +26.92% | -35.00% |

| 75th Percentile | £69,688 | £86,250 | - |

| 90th Percentile | £71,375 | - | - |

| UK median annual salary | £60,000 | £82,500 | £65,000 |

| % change year-on-year | -27.27% | +26.92% | -35.00% |

All Process & Methodology Skills

England

Credit Risk Analytics falls under the Processes and Methodologies category. For comparison with the information above, the following table provides summary statistics for all permanent job vacancies requiring process or methodology skills in England.

| Permanent vacancies with a requirement for process or methodology skills | 42,692 | 44,038 | 42,419 |

| As % of all permanent jobs advertised in England | 81.67% | 90.44% | 90.61% |

| Number of salaries quoted | 25,525 | 21,717 | 32,741 |

| 10th Percentile | £28,518 | £35,000 | £32,000 |

| 25th Percentile | £37,500 | £45,000 | £43,000 |

| Median annual salary (50th Percentile) | £55,000 | £60,000 | £60,000 |

| Median % change year-on-year | -8.33% | - | -4.00% |

| 75th Percentile | £76,250 | £81,250 | £80,000 |

| 90th Percentile | £96,750 | £100,000 | £100,000 |

| UK median annual salary | £55,000 | £60,000 | £60,000 |

| % change year-on-year | -8.33% | - | -4.00% |

Credit Risk Analytics

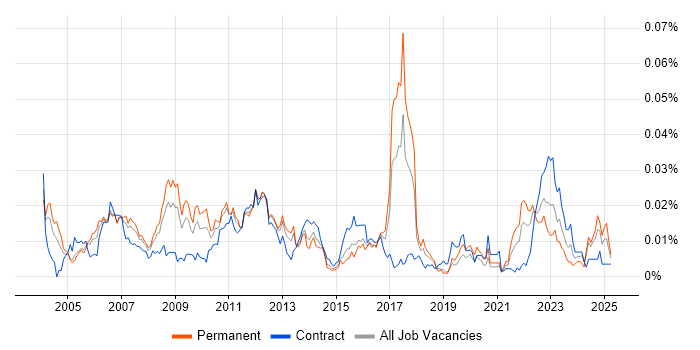

Job Vacancy Trend in England

Historical trend showing the proportion of permanent IT job postings citing Credit Risk Analytics relative to all permanent IT jobs advertised in England.

Credit Risk Analytics

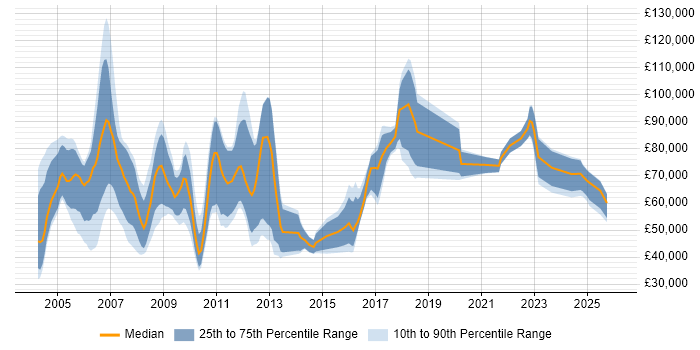

Salary Trend in England

Salary distribution trend for jobs in England citing Credit Risk Analytics.

Credit Risk Analytics

Salary Histogram in England

Salary distribution for jobs citing Credit Risk Analytics in England over the 6 months to 6 January 2026.

Credit Risk Analytics

Job Locations in England

The table below looks at the demand and provides a guide to the median salaries quoted in IT jobs citing Credit Risk Analytics within the England region over the 6 months to 6 January 2026. The 'Rank Change' column provides an indication of the change in demand within each location based on the same 6 month period last year.

| Location | Rank Change on Same Period Last Year |

Matching Permanent IT Job Ads |

Median Salary Past 6 Months |

Median Salary % Change on Same Period Last Year |

Live Jobs |

|---|---|---|---|---|---|

| London | +53 | 2 | £52,500 | - | |

| Midlands | +14 | 2 | £68,750 | -16.67% | |

| West Midlands | - | 2 | £68,750 | - | |

| South East | - | 1 | £42,500 | - | |

| Credit Risk Analytics UK |

|||||

Credit Risk Analytics

Co-Occurring Skills & Capabilities in England by Category

The following tables expand on the one above by listing co-occurrences grouped by category. They cover the same employment type, locality and period, with up to 20 co-occurrences shown in each category: